Investment Trends Shaping End-2025 and Beyond

As we approach the end of 2025, investment trends are shifting with new technological, environmental, and economic factors influencing the markets. Understanding these changes is crucial for investors looking to navigate the evolving landscape. From the rise of green investments to the growing prominence of artificial intelligence (AI), the key investment trends will shape the financial markets through the end of 2025 and beyond.

Sustainable and Green Investing

One of the most significant trends in the investment world is the increasing focus on sustainable and green investments. As climate change becomes an ever-present concern, investors are channeling their funds into environmentally friendly companies, renewable energy sources, and eco-friendly technologies. The trend is being fueled by consumer demand for greener products and services and government policies aimed at combating climate change.

By 2025, we expect further growth in the green bond market, which finances projects to reduce environmental impact. Investors are paying more attention to ESG (Environmental, Social, and Governance) metrics and using them as a criterion for making investment decisions. This is driven by ethical considerations and the potential for higher returns, as companies that prioritize sustainability are anticipated to perform well in the long run.

Additionally, renewable energy sources like wind, solar, and hydroelectric power are expected to continue rising, with major investments in developed and emerging markets. Innovations in green technology, such as carbon capture and storage (CCS), will also attract significant capital from forward-thinking investors.

Artificial Intelligence and Automation

Artificial Intelligence (AI) has become a cornerstone of the global economy, and it is transforming a wide array of industries. By the end of 2025, AI and automation will be at the forefront of investment strategies, as their capabilities in improving productivity and efficiency continue to expand.

Investors will increasingly allocate funds to AI-focused companies, particularly those in healthcare, finance, manufacturing, and logistics sectors. AI’s ability to drive innovation in these areas offers an attractive growth potential. For example, AI is being used in healthcare to develop personalized medicine, streamline diagnostics, and improve drug discovery. In finance, AI is revolutionizing risk management and trading strategies.

Automation, including robotics and smart manufacturing, will also attract investment as businesses seek ways to reduce costs and increase efficiency. The rise of autonomous vehicles, drones, and smart cities will further fuel the demand for technologies that rely on AI and automation.

For investors, AI presents a unique opportunity to gain exposure to cutting-edge technologies expected to dominate multiple sectors for years to come.

Blockchain and Cryptocurrency

Blockchain technology and cryptocurrencies have gained substantial attention over the last decade, and this trend is only set to accelerate. While the volatility of cryptocurrencies like Bitcoin and Ethereum has made them a controversial investment, blockchain technology holds immense potential across various sectors, including finance, healthcare, and supply chain management.

As we approach the end of 2025, institutional investors will increasingly turn to blockchain for its secure and transparent capabilities, particularly in decentralized finance (DeFi). Blockchain’s ability to streamline transactions, reduce fraud, and reduce the need for intermediaries makes it an attractive option for financial institutions, government agencies, and businesses alike.

While still facing regulatory hurdles, cryptocurrency is expected to evolve further as a legitimate store of value. As central banks around the world explore the potential of central bank digital currencies (CBDCs), the future of cryptocurrency could see greater adoption, particularly as a hedge against inflation in uncertain economic times.

For long-term investors, the blockchain space offers an innovative growth area, though it’s important to consider the risks and volatility associated with digital currencies.

Healthcare Innovation and Biotech

Healthcare and biotech have always been important sectors for investment, but the COVID-19 pandemic highlighted the need for innovation in these areas. As we head into 2025, advancements in biotechnology, personalized medicine, and digital health technologies will continue to attract substantial investment.

One key area of focus will be gene editing technologies like CRISPR, which have the potential to treat genetic disorders and revolutionize the way we approach medicine. Biotech companies working on new cancer treatments, vaccines, and anti-aging therapies will likely see increased funding as they develop breakthrough innovations.

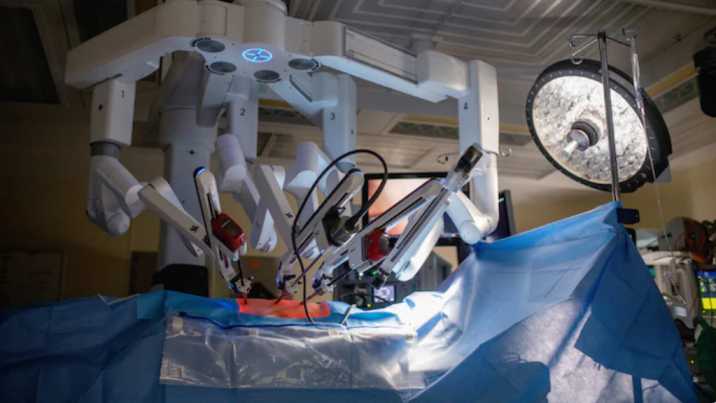

The global aging population is another factor driving investment in healthcare. As life expectancy increases, the demand for healthcare services, pharmaceuticals, and eldercare technologies will continue to grow. Investors will be focusing on companies that are developing innovative solutions to address these challenges, such as telemedicine platforms, wearable health devices, and robotic surgery systems.

The combination of healthcare innovation and demographic shifts presents a promising long-term investment opportunity for those looking to tap into a growing, dynamic sector.

Digital Infrastructure and 5G Networks

The rollout of 5G networks is set to be one of the most transformative technological shifts in recent years. By the end of 2025, we will see the global expansion of 5G infrastructure, enabling faster data transmission and unlocking the potential of the Internet of Things (IoT), smart cities, and connected devices.

Investment in 5G infrastructure will continue to rise, as telecom companies, technology providers, and governments work together to expand network coverage and build the necessary digital infrastructure. This will open up opportunities for businesses to innovate with new services and products that rely on faster connectivity.

The demand for data centers, cloud computing, and edge computing will also grow alongside 5G adoption. With more data being generated than ever before, businesses will need to invest in scalable and secure digital infrastructure to store and process this data.

Investors looking to profit from the digital transformation of the global economy should pay close attention to companies developing 5G networks, data centers, and related technologies.

Global Supply Chain Reshoring and Infrastructure Investment

The COVID-19 pandemic highlighted vulnerabilities in global supply chains, and as a result, many companies are now looking to reshore or diversify their production and sourcing strategies. By 2025, we will likely see significant investments in reshoring manufacturing capabilities, particularly in electronics, automotive, and pharmaceuticals.

Governments are expected to be key in incentivizing these investments, offering tax breaks, subsidies, and infrastructure support. As part of this trend, infrastructure investment will become increasingly important, as businesses look to build more resilient and diversified supply chains.

This trend presents opportunities for investors in construction, manufacturing, and logistics, particularly in emerging markets where infrastructure development is taking place rapidly.

Alternative Investments and Private Equity

Finally, alternative investments will continue to gain traction as investors seek to diversify their portfolios and reduce risk. Private equity, venture capital, and property investments will remain attractive, offering potential for high returns, especially in emerging sectors like green technology, AI, and biotech. In addition, precious metals, including high-quality silver bars, will remain a popular hedge against economic uncertainty and inflation.

With traditional investment avenues like stocks and bonds becoming more volatile, many investors are turning to alternative assets to hedge against economic uncertainty and inflation. While potentially more illiquid, these investments offer higher return potential in the long run, especially as innovative startups and businesses seek funding.

As we approach the end of 2025, alternative investments will likely continue to shape the financial landscape, providing opportunities for sophisticated investors willing to take on more risk in exchange for potentially greater rewards.

Conclusion

The investment landscape is undergoing significant changes as we move toward the end of 2025. From the rise of sustainable investing and AI to the expansion of digital infrastructure and biotech innovation, investors have a wide range of opportunities to explore. While these trends present exciting prospects for growth, they also come with their own set of risks. It will be essential for investors to consider these trends carefully, stay informed about technological developments, and adjust their strategies accordingly to maximize returns in a rapidly changing world.

One thought on “Investment Trends Shaping End-2025 and Beyond”